Opportunity Zones

Opportunity Zones are the latest tool to spur local investment for our local government partners and DFI is ready to help.

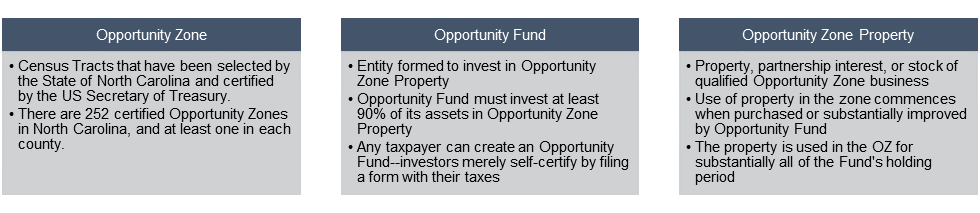

The Opportunity Zone (OZ) program, created as a part of the federal Tax Cuts and Jobs Act of 2017, aims to encourage private investment in low-income communities. There are 252 census tracts in North Carolina designated as OZs. Investors receive tax benefits for reinvesting capital gains into designated OZs. Real estate development projects make ideal OZ investments due to the long hold periods required to take full advantage of the federal tax benefits. The most strategic local governments will identify attractive development opportunities, make them “investment-ready,” and market them to as many OZ investors as possible. The development experts at the Development Finance Initiative (DFI) have successfully attracted private developers to dozens of North Carolina projects since 2011. OZs are simply the latest tool to spur local investment for our local government partners and DFI is ready to help.

How can local governments attract Opportunity Zone investors?

Investors must find investment-ready projects in OZs in order to take advantage of OZ tax benefits. The communities that will attract the most OZ investment will be communities that:

- identify attractive private development projects inside OZs,

- secure site control of those projects (do not cede control of the property to speculators)

- make those projects “investment ready,” and

- market them to as many OZ developers and investors as possible.

UNC DFI has worked with over 75 local governments since 2011 to attract private investors for transformative projects, so DFI is accustomed to performing these steps for local government-controlled property. DFI also stands by its local government partners until the investment closes.

When should local governments act?

A full pre-development process will typically take at least 6 to 12 months. DFI recommends that local governments begin pre-development activities for OZ projects as soon as possible to maximize the value an Opportunity Zone designation can provide to investors.

Because of the timing for tax basis changes and the payment requirement for deferred Cap Tax after 2026, equity invested in OZs before the end of 2019 will receive the greatest tax benefit. Therefore, projects that are ready for investment by the end of 2019 will be most attractive to investors.

Investment timeline

Investment impact

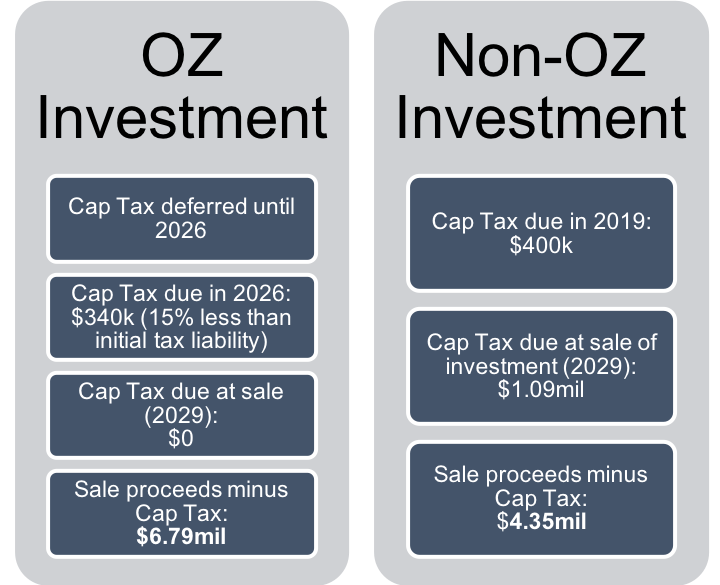

The example below illustrates the impact of OZs on two otherwise equal equity investments. Given a $2 million investment held for 10 years, after-tax return at sale is 56 percent greater, representing an additional $2.4 million, for the OZ investment. (This example is provided for illustration purposes to aid local government officials in understanding the impact and operation of Opportunity Zones on an investor’s returns. Actual returns may vary depending on the risk profile of the investment. Investors should contact their personal tax advisors to learn how an Opportunity Zone investment would affect their personal tax situation.)

Example Assumptions

Because the impact of Opportunity Zone investments is dependent on several variables, this example assumes the following conditions:

- $2M capital gains invested

- Cap Tax rate – 20%

- Investment made in 2019

- Investment sold after 10 years

- 13% annual asset appreciation

Investments that pair well with Opportunity Zones

Though the Opportunity Zone program does not limit private investment potential to projects that meet community economic development priorities, strategic local governments can meet community goals by positioning Opportunity Zone properties for:

- Affordable housing & workforce housing projects

- New Markets Tax Credits projects

- Historic Tax Credits projects (as long as improvements made to the investment are equal to or greater than initial investment over any 30-month period during the investment)

- Market-rate development

Investment Mechanics

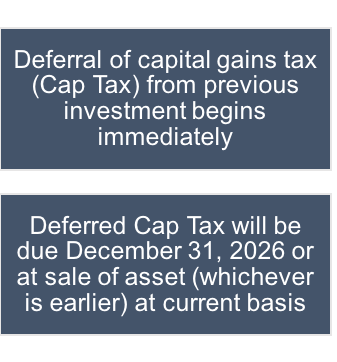

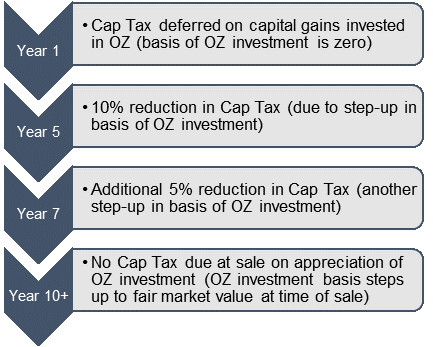

- Capital gains realized after December 31, 2017 and reinvested in Opportunity Funds receive federal capital gains tax deferral until December 31, 2026 or until sale of Opportunity Zone investment (whichever comes first)

- To receive tax benefits, Opportunity Funds must invest in “qualified opportunity zone property” (link is external) for substantially all of the Fund’s holding period

- Capital gains tax is effectively reduced for Opportunity Fund investments by increasing the basis of the Fund investments at year 5 (by 10%) and year 7 (by 5% more)

- Opportunity Fund investments held for 10 or more years will pay no capital gains on appreciation of the Fund, due to step-up in basis to fair market value at time of sale

DFI’s pre-development process is well suited for Opportunity Zones

UNC DFI’s pre-development process includes in-depth market, site, and financial analyses, identification of potential development partners, and guidance on structuring public-private partnerships. This pre-development process pairs well with the OZ program and can allow local governments to create investment opportunities with transformative community impact.

The Opportunity Zone program is a new way to incentivize investment in communities across the state. For most communities, the designation of an Opportunity Zone, on its own, may not spur development activity. UNC DFI can help local governments develop strategies to not only attract investment, but to create projects that achieve local goals. For more information about Opportunity Zones and how DFI can help your community prepare for OZ investors, contact Marcia Perritt at mperritt@sog.unc.edu (link sends e-mail). If you would like to read more, here are a few of our featured OZ projects.